اخبار میکر

2️⃣ Support for the new TUSD implementation contract, which will allow collateral operations of TUSD-A to resume.

This is a mitigation action to prevent malicious governance from re-activating the Flash Mint Module module after the FlashKiller contract disables it.

1️⃣ The Emergency Shutdown Module will be authorized to revoke Governance control over the Flash Mint Module after an Emergency Shutdown.

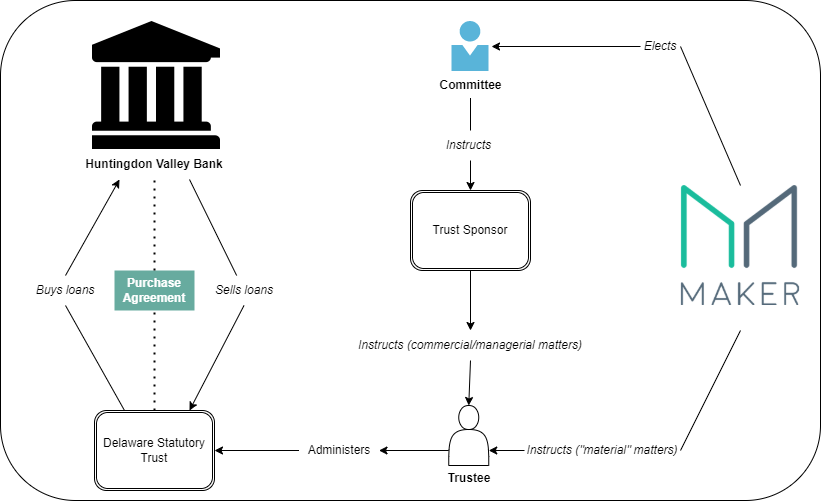

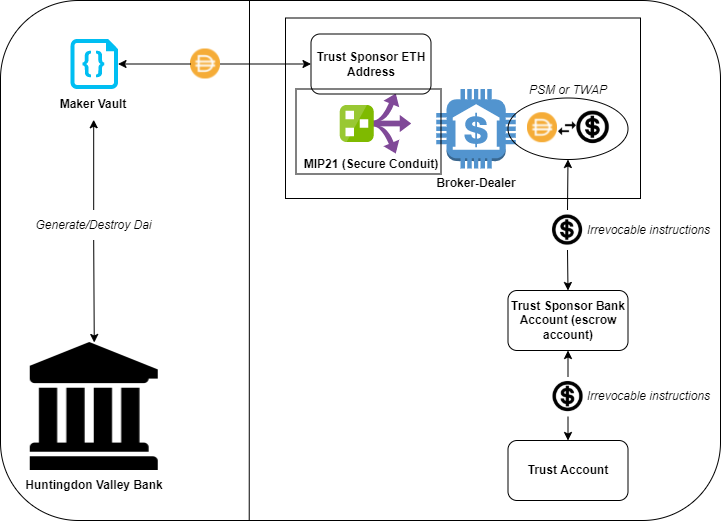

This application proposed a legal structure wherein Huntingdon Valley Bank enters into a Master Purchase Agreement with a trust for the benefit of MakerDAO. The legal structure also has the intention to incorporate more banks in the future.

Huntingdon Valley Bank, a Pennsylvania Chartered Bank founded in 1871, has submitted a Collateral Onboarding Application to MakerDAO. If approved by Governance, it will be the first collateral integration from a US-based bank into the DeFi ecosystem. https://t.co/w1UpzyoxOm

Also, you can check our Recognized Delegates able to receive your MKR delegation here: https://t.co/dcimrx8gWV

The recent change to the TUSD contract has effectively locked users’ collateral in the Maker protocol. This executive action is a preliminary step that will allow vault owners to withdraw their collateral (if they wish to do so) as part of the TUSD offboarding process

Do you want to meaningfully participate in the future of MakerDAO? We encourage you to vote or delegate with your MKR. You can see the Executive Proposal already posted here: https://t.co/5pjarhMhkc

The application also requested an initial debt ceiling of $100 million dollars of Huntingdon Valley Bank Participated Loans diversified across all proposed loan categories, to be deployed over a period of 12 to 24 months from inception. https://t.co/lcZBY68BYB

The First Portfolio Purchase Agreement proposed is for equal participation in loans that are originated by Huntingdon Valley Bank or are loans purchased or syndicated from another financial institution. https://t.co/I8AKBSkLfj